A Practical Guide to PRS in Malaysia (For Normal People Who Just Want Lower Tax and Lower Risk)

Private Retirement Scheme (PRS) is a long-term voluntary savings initiative introduced by the Malaysian government to encourage Malaysians to invest for retirement.

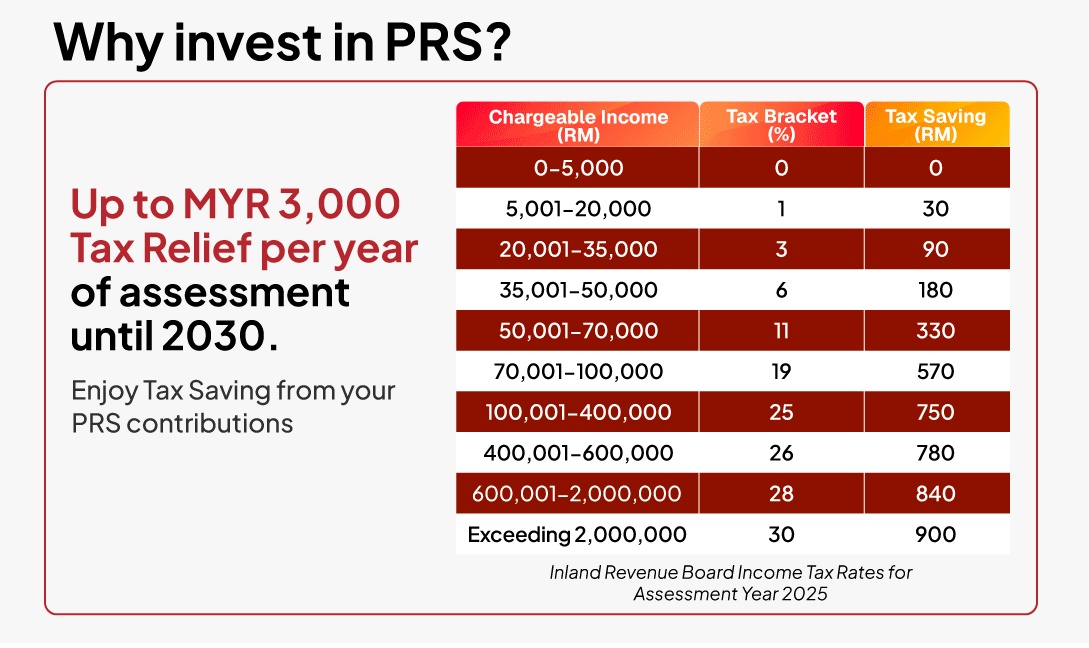

You can claim up to RM3,000 in personal tax relief each year when you contribute to PRS. Under Budget 2025, this tax relief has been extended until 2030, making PRS one of the easiest legal ways to reduce your income tax bill.

But here is the honest truth:

Most PRS funds in Malaysia underperform.

If you treat PRS like your main investment portfolio, you may end up disappointed.

Because of that, my PRS strategy is simple and practical.

How to Choose a PRS Fund (My Honest Criteria)

1. Prioritise downside protection, not high performance

PRS funds are locked until age 55. Since your money will be tied up for decades, your priority should be stability, not chasing the highest possible return.

When you compare PRS funds, look for:

- Low volatility

- Low probability of negative returns

- Consistent performance versus their benchmark

- Diversified asset allocation

PRS should complement your main investment portfolio, not replace it.

2. Use platforms with low fees

Many PRS distributors still charge high sales fees. Over decades, these costs compound and quietly eat into your returns.

This is why I prefer using FSMOne, which:

- Charges zero per cent sales charge on PRS

- Is straightforward to use

- Provides clear and transparent fund information

When your money is locked for 20 to 30 years, fee efficiency matters a lot.

FSMOne PRS Campaign 2025: Enjoy RM40 FSMOne Cash Account.

From 6 October 2025 to 15 December 2025, you can receive RM40 FSMOne Cash Account credits when you invest in PRS funds via FSMOne. If you are planning to contribute to PRS this year, this is a simple bonus to capture on top of your RM3,000 tax relief.

My Top Recommended PRS Funds (2025 Edition)

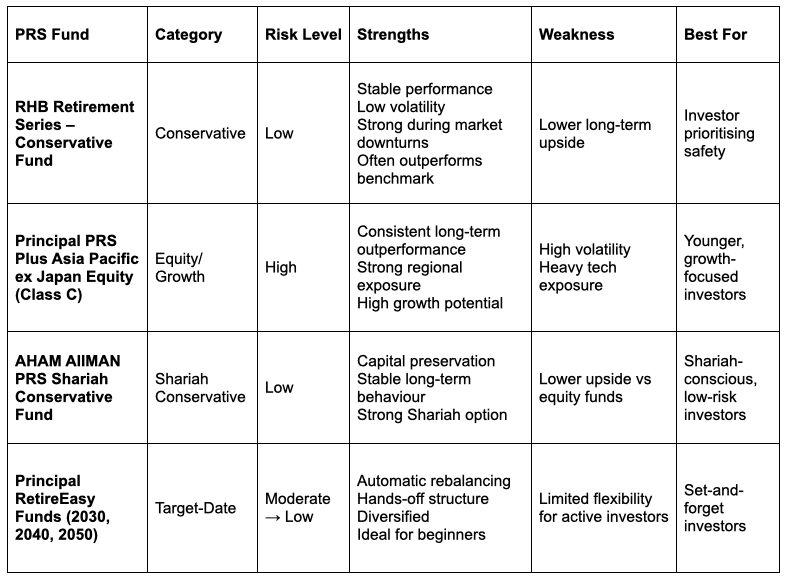

These funds make sense for different types of investors, balancing stability, consistency and practicality over the long term.

1. RHB Retirement Series – Conservative Fund

Best for: People who want stability and a low chance of losses

Why it stands out:

- Consistent conservative fund

- Low volatility

- Strong during downturns

- Often beats its benchmark

2. Principal PRS Plus Asia Pacific ex Japan Equity (Class C)

Best for: Long-term growth seekers

Why it’s attractive:

- Rare PRS equity fund with consistent long-term outperformance

- Strong exposure to Asia Pacific ex-Japan

- High tech concentration – expect higher volatility

Ideal for younger investors or those with a long horizon.

3. AHAM AIIMAN PRS Shariah Conservative Fund

Best for: Shariah-conscious and low-risk investors

Why it’s strong:

- Strong capital preservation profile

- Stable and predictable

4. Principal RetireEasy Funds (Target-Date Series)

Best for: Truly “set and forget” investors. These target-date PRS funds align with expected retirement years (2030, 2040, 2050, etc.).

Why it’s useful:

- Choose the retirement year closest to you

- Automatic rebalancing as you age

- High equity when young, more bonds as you get older

PRS Comparison Table (2025 Edition)

The Fine Print: What You Must Know

The 70/30 structure

- 70% → Sub-account A (locked until 55)

- 30% → Sub-account B (withdrawable with penalty)

Withdrawal rules

- Early withdrawals before age 55 incur an 8% tax penalty

- Only Sub-account B can be withdrawn early

- No penalty for death, disability or leaving Malaysia permanently

Final Thoughts

PRS is not meant to be your main investment strategy, but it is a powerful tool for:

- Reducing income tax

- Building long-term retirement stability

- Encouraging disciplined saving habits

If you treat PRS as a tax benefit, a long-term safe parking space, and a complement to your main investments, you will get stress-free retirement savings that grow slowly and steadily.